How to start a business in Germany?

Foreigner can expand the boundaries of their business through business in Germany, setting a German company individually and from scratch, or enter into a share with German partners. An option for entering a German business would be to purchase a ready-made business in Germany or a franchise.

Business in Germany seems much more stable and reliable to many businessmen. And they are right about that! In addition, legal issues in Europe are much better organized. Plus, Germany even welcomes business immigration! Although the barrier to entry into German business is considerable. However, you will fall under this policy only if you invest at least 250 thousand euros in the German economy – a very tidy sum! Plus, at least five jobs must be created. Do you remember that their salaries are fair and significant? And do you have to pay taxes on them? And who the hell are you going to kick out of work…

Of course, the first questions that arise are legal and visa issues.

And believe me, if you already have business experience, you will be able to start a business in Germany.

Algorithm for starting a business in Germany:

| First |

· search for a business idea |

| Second |

· drawing up a business plan |

| Third |

· registration of the enterprise itself |

| Fourth |

· selection of premises and employees. |

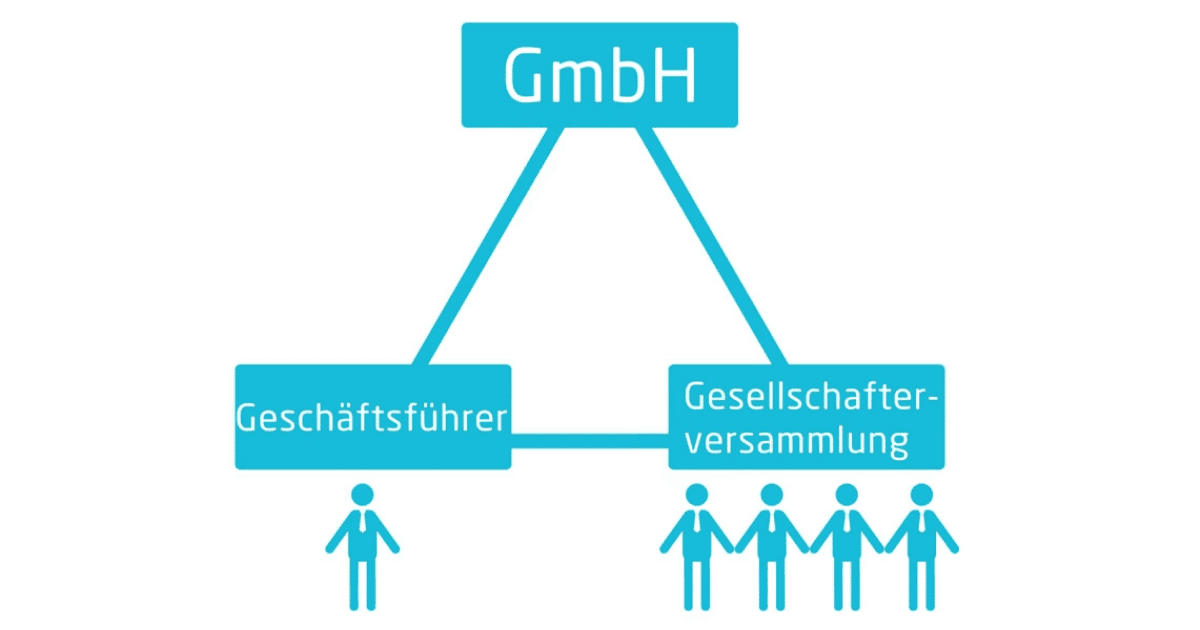

The director of the company must have the right to work in Germany. As for the founders (or founder), their participation may be limited to signing an agreement at a notary office and opening a corporate bank account. In this case, the only document required is a passport. All other formalities, including the preparation of constituent documents and registration of a legal entity in the Trade Register, can be entrusted to lawyers.